AUTOMOTIVE INDUSTRY IN GERMANY

Germany is Europe ́s biggest automotive market. It is Europe ́s number 1 in production and sales terms accounting for 25% of all passenger cars manufactured and almost 20% of all new new registrations.

Germany produced 3.1 Million passenger cars and 351.000 commercial vehicles in 2021 making Germany Europe ́s leading production site. Automotive exports account for more than 13% of all German exports in 2021.

15 of the world ́s Top-75 automotive suppliers are German companies.

Germany has the largest concentration of OEM manufacturing plants in Europe. There are currently 44 OEM sites located in Germany which is more than 55% of all OEM plants in the European Union area.

The premium market segment will be expected to grow at a much faster rate than the total passenger car segment in the next decades. There is a growing international demand for high-value, premium small- and compact-sized cars as well as premium SUVs. The German automotive industry is one of the world ́s leading producers of premium car. Almost all German and Germany-based manufacturers have already launched or intend to laund new products meeting premium segment demand.

Main technological trends in German automotive industry are:

- carbon-emission reduction

- smart traffic management

- smaller, highly charged-up homogenous combustion engines

- dual clutch transmissions (DCTs)

- e-mobility solutions

- car connectivity and IoT-technologies

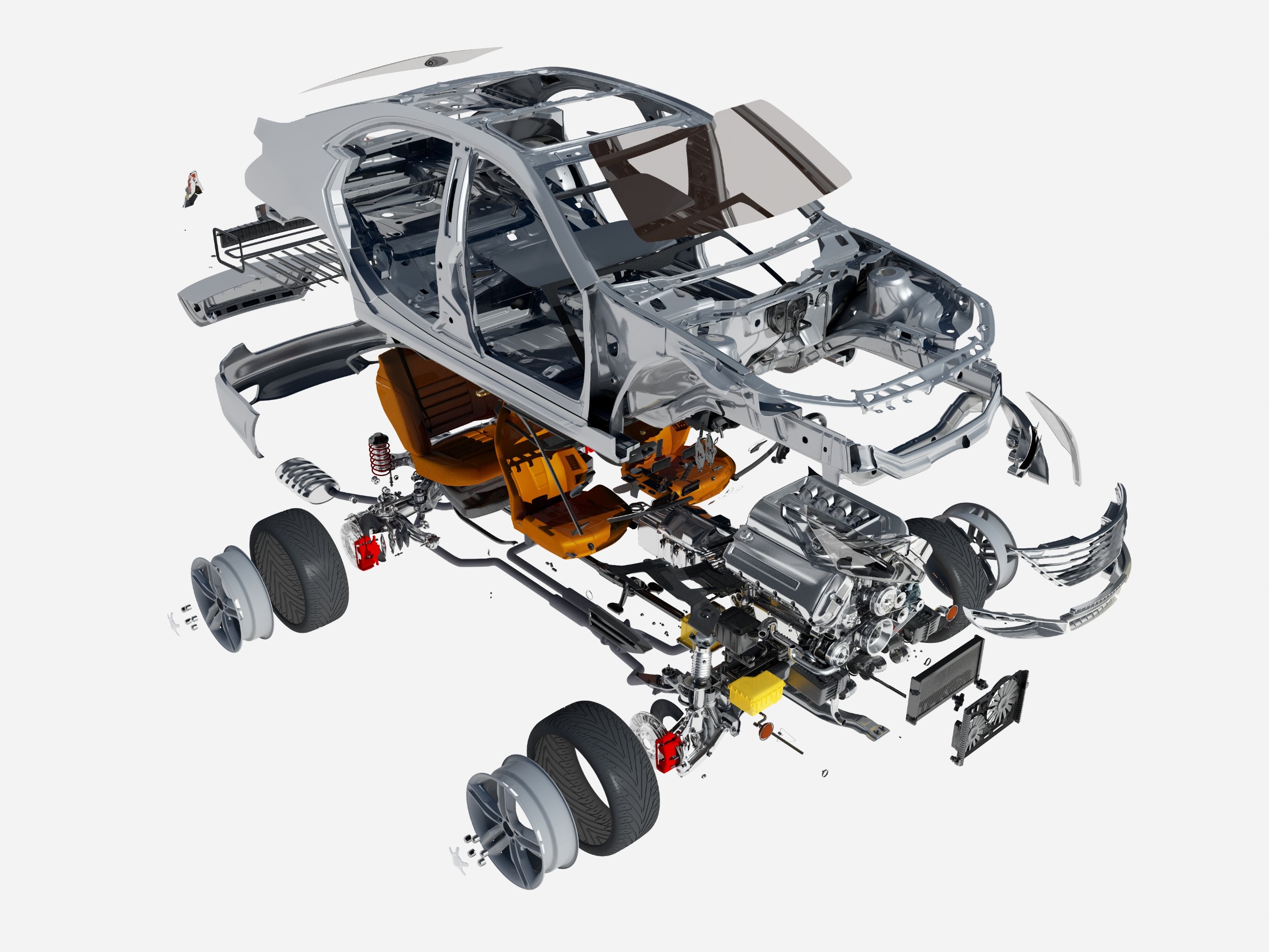

- new lightweight materials and hybrid lightweight components using metals, plastics and textile structures

- focus on interiors and comfort: new seat concepts, functionalized surfaces and new materials

Due to worldwide Covid-19 pandemic, it is seen as crucial to create new supply chains in the automotive industry and reduce dependency on critical components coming from China. The German OEMs report the microelectronics-intensive premium segment has been most affected by the pandemic and other disruptions in the supply chains, but the situation is forecased to ease within 2023.

German automotive industry is decentralized across the country. Main automotive clusters are located in Southern Germany in states of Bavaria and Baden-Württemberg. Other important automotive industry locations are states of North Rhine-Westphalia, Saxony-Anhalt, Saxony and Berlin-Brandenburg.

Main considerations for automotive suppliers entering the most advanced European market include:

- determining where you are in the feeding chain: Tier-1, Tier-2, Tier-3

- technological advantages that your company and products offer: what is your specific added value

- considerations on location: which automotive cluster in Germany is your best target

- references and customer testimonials